PF Return Filing in Mumbai

PF Return Filing in Mumbai is an essential statutory process for all establishments that are registered with the Employees’ Provident Fund Organisation (EPFO). With the recent re-engineering of the Electronic Challan cum Return (ECR) system, all Mumbai-based businesses must understand the new procedures for seamless filing and compliance. This detailed guide draws on the official EPFO User Manual for the latest process and local best practices, optimizing for businesses in Mumbai searching for effective, updated help on PF Return Filing in Mumbai

Why PF Return Filing in Mumbai Matters

Filing a PF return is a mandatory compliance requirement for Mumbai businesses with 20 or more employees. Besides avoiding heavy penalties and legal issues, accurate and timely PF Return Filing in Mumbai ensures:

- Seamless employee social security benefits

- Enhanced trust among staff

- Hassle-free audits

- Eligibility for government contracts and incentives

The Latest Changes in PF Return Filing in Mumbai (2025)

The EPFO’s new ECR system brings several key improvements and procedural changes for businesses:

- Re-engineered Return Modules: Separate modules for Regular, Supplementary, and Revised Returns.

- Granular Dashboards: Wage monthwise return summary allows search and quick access to all returns.

- File Validation and Error Handling: Automated error files for failed uploads, with exact pinpointing of issues.

- Modular Payment Options: Employers can pay through full or part payments, or settle administrative charges/damages separately.

- Tighter Timelines: New validation rules will enforce prompt, complete filing of membership records within four months.

- Streamlined Digital Signing: Updated digital signature process for authentication.

Step-by-Step PF Return Filing Procedure in Mumbai Using New ECR

Follow the latest workflow to complete PF Return Filing in Mumbai successfully:

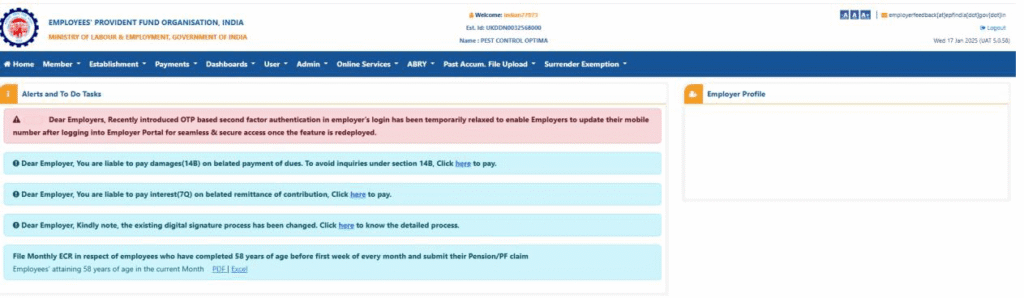

Employer Login & Dashboard Access

Begin by logging into the EPFO employer portal with your credentials. The home screen provides access to Payments, Dashboards, and Online Services.

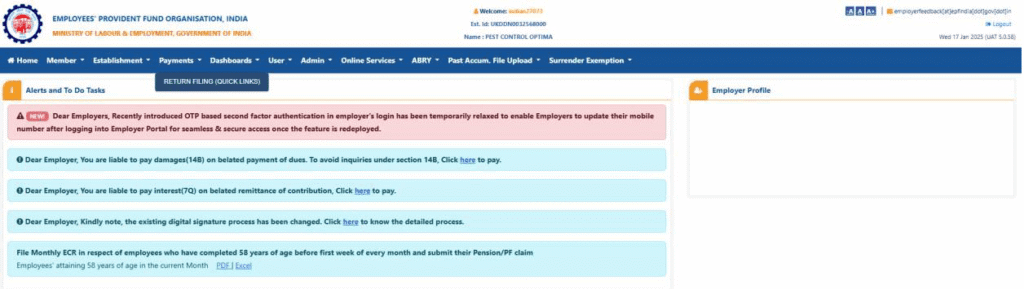

Navigating to Return Filing

Select the 'Payments' tab and click 'Return Filing Quick Links.' Here, you’ll see options for:

- Filing new returns

- Viewing return history

- Filing arrear returns or direct challan entry

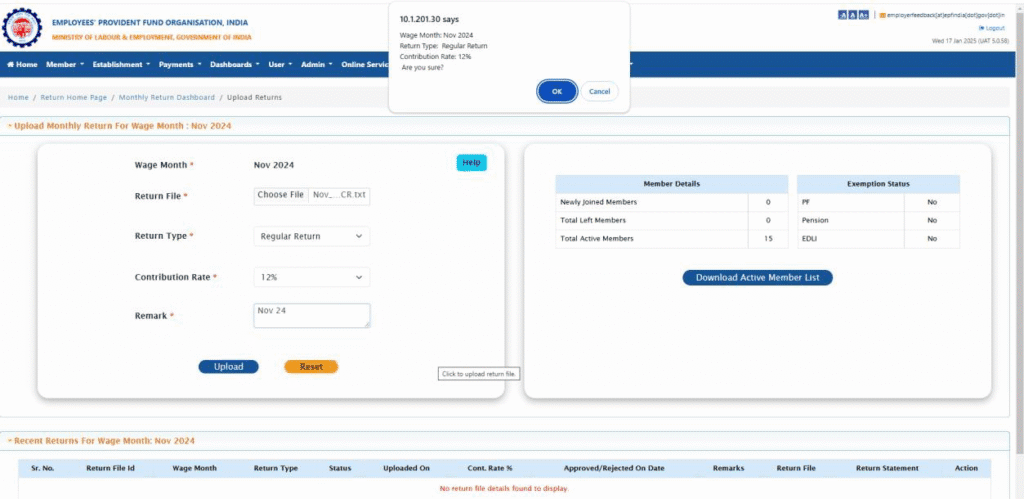

3. Return Monthly Dashboard

From the Return Home Page, navigate to the Monthly Dashboard. Here, search for a specific wage month to review or file new returns. The dashboard displays:

- Number of active, newly joined, or exited members per month

- Contribution summary (EPF, EPS, EDLI)

4. Preparing and Uploading the Return File

- Download the template for the Regular Return file (text format, max 8 MB or as a zipped file if larger).

- The return file must have precise structure:

UAN | Member Name | Gross Wages | EPF Wages | EPS Wages | EDLI Wages | Employee PF Contribution | Employer EPS Contribution | Employer PF Contribution | NCP Days | Refund of Advance - Access the 'Help' section within the Monthly Return Dashboard for guidelines and a sample format.

5. Uploading and Validating the ECR Return

- Upload your .txt (or .zip) file and pick 'Regular Return' from the dropdown.

- Click 'Upload.' Validation runs automatically.

- If successful: File moves to the In-Process Returns list.

- If errors: Download the error file, correct issues, and re-upload.

6. Review, Approve, or Reject Returns

- Download the auto-generated return statement and thoroughly verify all contributions and membership data.

- If correct, click 'Approve'. If incorrect, click 'Reject,' revise data, and re-upload.

7. Due Deposit and Payment Processing

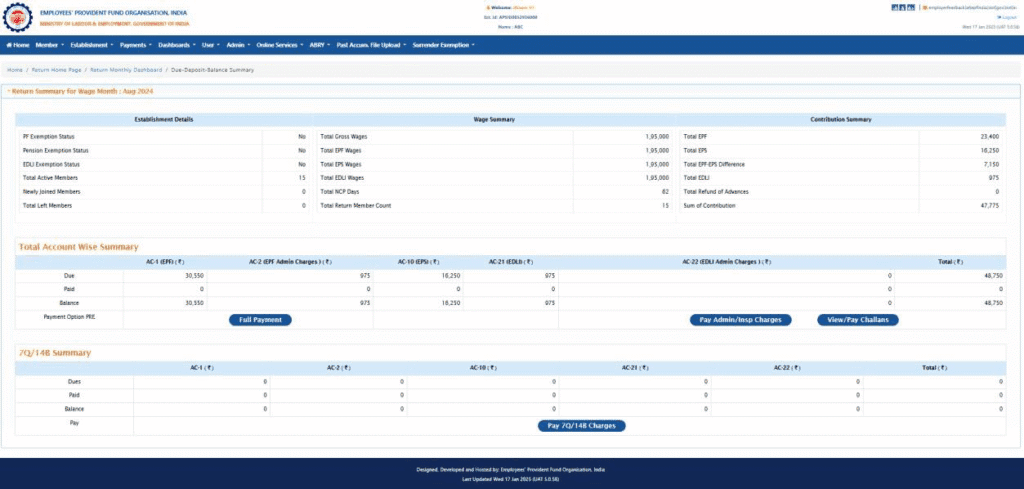

Once approved, a Due-Deposit-Balance Summary is displayed for the wage month listing:

- Gross wages

- Contribution totals by account (AC-1, AC-2, AC-10, AC-21, AC-22)

- Refunds and balance summaries

Choose from payment options:

- Full Payment: Settle all PF dues cumulatively for the month.

- Part Payment: If unable to pay in full, settle dues partially and complete payment later.

- Admin/Inspection Charges: Prepare a separate challan for administration and inspection charges (accounted under AC-2 and AC-22).

8. Challan Generation and Payment

- Generate the challan by selecting the Payment Option and Finalizing.

- Make payment via net banking using one of the listed banks.

9. Filing Supplementary or Revised Returns

- Supplementary Returns: Use this to add newly joined employees not included in the regular return for that wage month.

- Revised Returns: Use to correct wage/contribution errors for specific members from prior returns; new details will overwrite previous records for those members.

10. Downloading Acknowledgment

After successful payment, download the Challan Receipt and keep it for your compliance records. The portal lists all successful and cancelled challans for reference.

New Compliance Guidelines for 2025

- Member Data Completion: After a four-month window, system enforces that regular returns for any month will only be allowed if all active members of four months prior have been filed. Non-compliance blocks further returns.

- Digital Signature Update: The DSC process is changed; employers must update credentials for smooth authentication.

- Interest and Damages: Built-in process to auto-calculate interest (7Q) and damages (14B) for late payments.

Supplementary: Error Handling & Support

Employers can download error files after unsuccessful uploads – these clearly indicate the error type for every record. Use the file to rectify and re-upload, ensuring that PF Return Filing in Mumbai remains error-free and on schedule.

Best Practices for PF Return Filing in Mumbai

- Update employee KYC and UAN data consistently.

- Validate all wages and contributions before uploading.

- Keep digital signature tokens updated for seamless authentication.

- File returns within statutory timelines to avoid damages and interest.

- Use the 'Help' features in the EPFO portal for the latest return file structures and ancillary documents.

- Retain all payment receipts and challans for audit and statutory proof.

Frequently Asked Questions

All registered establishments in Mumbai with 20 or more employees (or those registered voluntarily) must file monthly PF returns.

Yes, all returns from 2025 must use the re-engineered ECR module on the EPFO portal.

The return and payment should be filed and completed by the 15th of every month for the previous wage month.

By partnering with Kaizen Consultancy Services, businesses can navigate the complexities of labour law compliance effortlessly. Our expert guidance ensures that you remain compliant while focusing on your core operations. Embrace the importance of a robust compliance strategy today for a sustainable future in your business endeavours.

Contact our expert Labour Law Consultants – Kaizen Consultancy Services today to streamline your construction compliance!