Pradhan Mantri Viksit Bharat

Rozgar Yojana

The Pradhan Mantri Viksit Bharat Rozgar Yojana (PMVBRY) is a government initiative launched as part of the “Prime Minister’s Package for Employment and Skilling” to stimulate job creation, formalize the workforce, and enhance employability. Implemented by the Ministry of Labour and Employment through the EPFO, the scheme is effective from August 1, 2025, with a registration window open until July 31, 2027.

Pradhan Mantri Viksit Bharat Rozgar Yojana Scheme Structure

The scheme is divided into two primary parts targeting different stakeholders:

Part A: First Timer Employees

- Objective: Assists new entrants to the workforce during their initial learning curve.

- Incentive: A one-time benefit of up to ₹15,000, calculated as one month's EPF wage.

- Eligibility: Employees with gross monthly wages up to ₹1 lakh who have never been contributing members of the EPFO.

- Payment: Disbursed in two instalments:

- 1st Instalment: Up to ₹7,500 after 6 months of continuous employment.

- 2nd Instalment: The remaining balance (up to ₹7,500) after 12 months, contingent on completing a mandatory Financial Literacy Course.

Part B: Support to Employers

- Objective: Incentivizes establishments to generate additional employment beyond a set "baseline".

- Incentive Duration: Benefits are provided for 2 years in all sectors, extending to 4 years for the manufacturing sector.

- Threshold Criteria: To qualify, small establishments (baseline < 50) must add at least 2 employees; larger ones (baseline 50+) must add at least 5.

- Monthly Benefit Rates:

- EPF Wage ≤ ₹10,000: Up to ₹1,000.

- EPF Wage > ₹10,000 to ≤ ₹20,000: ₹2,000.

- EPF Wage > ₹20,000 to ≤ ₹1,00,000: ₹3,000.

Key Definitions & Operational Details

- Baseline: For existing firms, it is the average number of employees for the 12 months prior to August 2025. New establishments have a fixed baseline of 20.

- Authentication: Incentives for first-timers require Face Authentication via the UMANG App. Employers must have a unique PAN and Aadhaar-linked bank accounts.

- Mode of Payment: All incentives are disbursed via Direct Benefit Transfer (DBT) to Aadhaar-seeded bank accounts.

- Financial Outlay: The total budget for the scheme is limited to ₹99,446 Crores.

Governance and Monitoring

- Steering Committee: An inter-ministerial body chaired by the Secretary (Labour & Employment) provides policy direction and budget approvals.

- Executive Committee: Chaired by the Central Provident Fund Commissioner (CPFC), it handles monthly project implementation and IT system approvals.

- Fraud Prevention: The scheme utilizes API integration with GST, Income Tax, and MCA data to identify fraudulent activities and corroborates employment with electricity or tax records.

- Grievance Redressal: EPFO will provide an online portal and call centre to resolve stakeholder issues within a 15-day timeframe

Key takeaways

Scheme Overview and Objectives

- Vision: Launched to achieve the vision of "Viksit Bharat@2047" as part of the Prime Minister's Package for Employment and Skilling1.

- Core Purpose: To stimulate employment creation, promote formalization of the workforce, and enhance employability for the youth.

- Timeline: The scheme is effective from August 1, 2025, with a registration period ending on July 31, 2027.

- Implementing Agency: The Ministry of Labour and Employment through the Employees' Provident Fund Organisation (EPFO).

Employer’s Responsibility

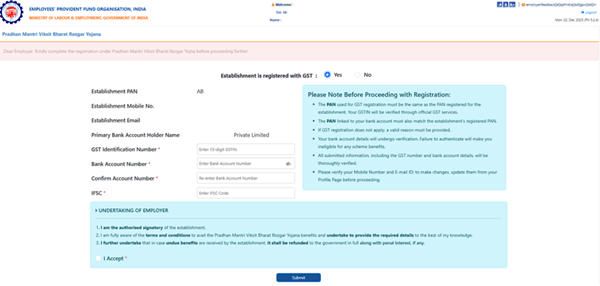

Employers need to update GST number & Current Bank account details & approve it with the DSC token. Refer below Screenshot for reference.

Need Help with Pradhan Mantri Vikasit Bharat Rozgar Yojana?

Kaizen Consultancy Services, a trusted Labour Law Consultant in Mumbai, can help you understand and apply these Pradhan Mantri Vikasit Bharat Yojana. We make sure your Mumbai business stays Labour Law Compliant and treats workers fairly. Contact Kaizen Consultancy Services today for professional and all labour law matters in Mumbai. Your business will thank you!

Kaizen Consultancy Services, a trusted Labour Law Consultant in Mumbai, can help you understand and apply these new rules. We make sure your Mumbai business stays Labour Law Compliant and treats workers fairly. Contact Kaizen Consultancy Services today for professional, friendly advice on the Labour Codes 2025 and all labour law matters in Mumbai.